Changes to NCAT’s Monetary Jurisdictional Limit for Consumer Claims

The Fair Trading Act 1987, section 79S provides a jurisdictional limit with respect to the value of a claim in which the Tribunal can make orders. This value is called the prescribed amount, and up until 18 July 2022, this amount was $40,000.

However, on 18 July 2022, the Fair Trading Amendment (Monetary Limit on Orders) Regulation 2022 came into effect, amending the prescribed amount, increasing it to $100,000.

This change has created questions regarding its retrospective application with respect to claims where the cause of action accrued and proceedings were commenced prior to the increase, but have remained on foot thereafter, and, on the flip side of the coin, claims when the cause of action accrued and proceedings were commenced thereafter the increase.

Actol Pty Ltd v Rise Products Pty Ltd; Rise Products Pty Ltd v Actol Pty Ltd

Facts

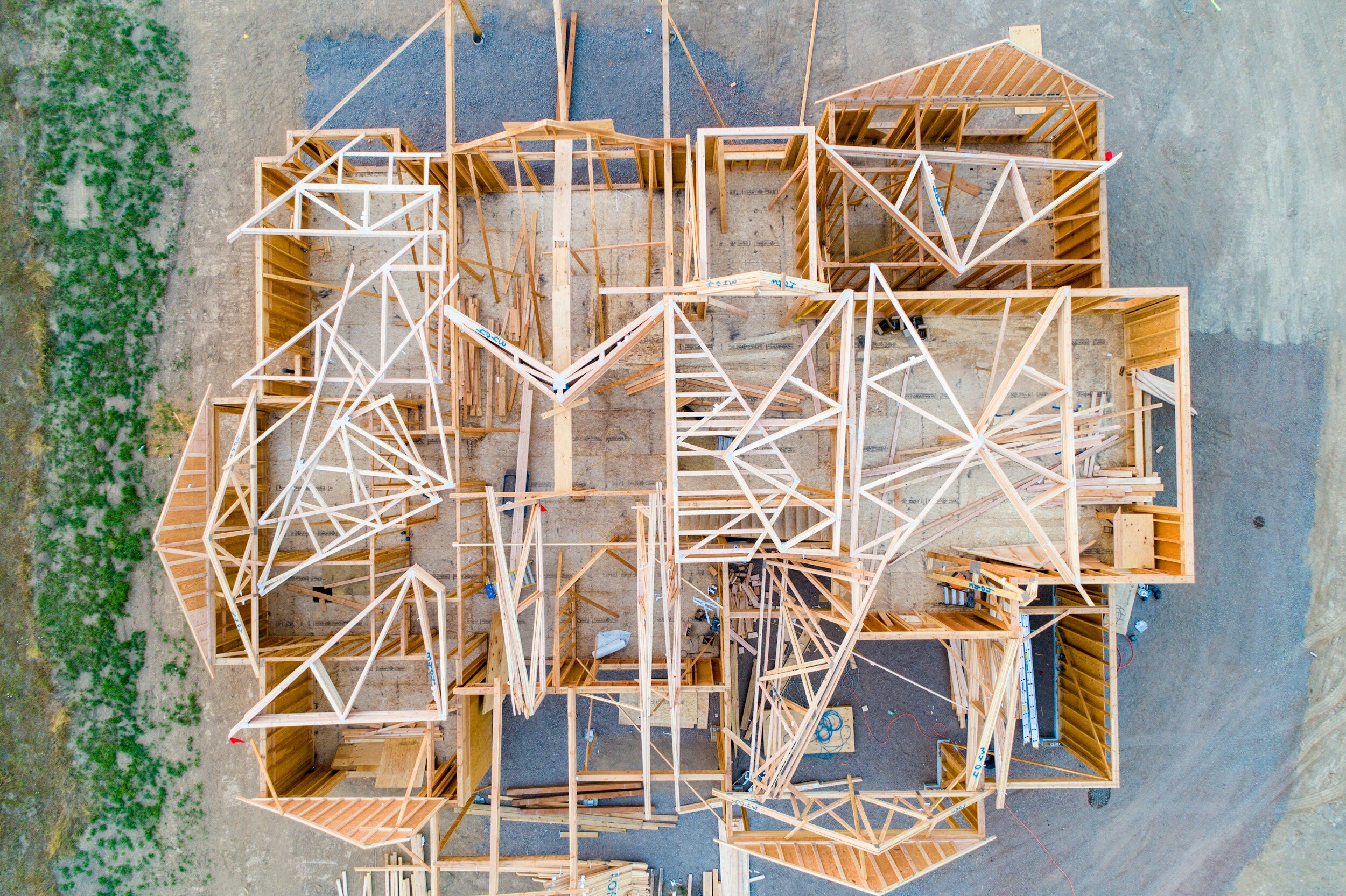

Actol Pty Ltd (“Actol”) owned a parcel of land located at Kellyville, which they sought to develop by constructing four (4) separate dwellings (“the Works”) on the land.

Actol subsequently engaged two (2) separate companies to complete the Works and one (1) company to manufacture and supply formwork systems. The companies engaged to complete the building works being Benth Holdings Pty Ltd t/as Gledswood Projects and 3 Form Structures Pty Ltd. Rise Products Pty Ltd (“Rise”), was engaged to manufacture and supply prefabricated concreting framework systems (“Risewall products”).

Actol claimed that the Risewall products supplied and subsequently used for the Works were defective and sought compensation for rectification works, damages for subsequent delay in completion of the Works and sought the repayment of an advanced payment made by Actol to Rise for further Risewall products not supplied.

Actol commenced proceedings in the NCAT, Actol Pty Ltd v Rise Products Pty Ltd; Rise Products Pty Ltd v Actol Pty Ltd in the Consumer and Commercial Division. The matter was set for hearing on 12-13 October and 4 & 29 November 2021, with both parties providing final submissions on 16 May 2022, and further supplementary submission on 14 & 22 November 2022 which attempted to deal with the issue of the retrospective application of the change to the monetary limit for consumer claims.

Senior Member Robertson found that with respect to the overpayment claim made by Actol, the amount was quantified at $50,650.60 and that, although at the time the application was made, the relevant jurisdictional limit was $40,000, the amended limit of $100,000 should be retrospectively applied and as such, orders were made for Rise to pay Actol the full amount.

Critical Issue

Should the changes to the jurisdictional limit be retrospectively applied.

Appeal

The matter was appealed to the NCAT Appeal Pannel, with one of the issued in dispute being the retrospective application regarding the changes to the jurisdictional limit. With respect to this issue, Principal Member Suthers and Senior Member Curtin SC determined that:-

“There is a presumption at common law that a stature or regulation should not generally be construed so as to operate retrospectively in the absence of a clear legislative intent that it should do so”.

“In our view, the correct application of the MLO regulation is derived from the nature of the change it effects. By that we mean that whilst no new right is created, nor liability imposed by it, existing rights would be altered if the amendment were to apply retrospectively to past events”.

“We do not think the effect of reg 13A inserted by the MLO Regulation can be said to be “merely procedural” in that context. The appellant had an existing right to ensure that any claim against it exceeding $40,000 would need to be contested in a court where the rules of evidence would apply. Variation of that position had such a significant effect in disturbing settled expectations that the presumption against reg 13A (retrospectively) affecting the claim should apply”.

“We are satisfied that the answer to the question of law whether “the amendment to the Tribunal’s monetary jurisdictional limit effected by the Fair Trading Amendment (Monetary Limit on Orders) Regulation 2022 (NSW) operate in respect of the claim by Actol under the Fair Trading Act?”, is “no””.

Summary

The Appeal Panel held that the increase to the Tribunals monetary jurisdictional limit for consumer claims under the Fair Trading Act 1987 does not operate retrospectively for claims where the cause of action accrues, and proceedings are commenced, prior to the date of amendment. As a result, the monetary jurisdictional limit was $40,000.

[2023] NSWCATAP 259 [46].

[2023] NSWCATAP 259 [56].

[2023] NSWCATAP 259 [60].

[2023] NSWCATAP 259 [62].